Business owners often think that they need to take dramatic steps to improve the profitability of their business. Many believe, for example, that if they want to double their profits, they need to double their sales. Still others think that they need to take on many more people, thus bringing with it, many more headaches. This doesn’t have to be the case. The difference between the DNA of a chimpanzee and a human is only 2% but what a difference that makes. 2% less and you are spending the rest of your natural life learning how to crack open a nut and 2% more and you can fly a rocket to the moon.

You may be surprised to find that the difference between a successful and an unsuccessful business is surprisingly similar.

So, what is the DNA of profitability in a business?

Broadly speaking there are five simple areas that we can look at to improve the profitability of a business. Let’s start to build these areas up one by one.

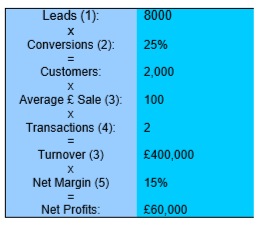

Having measured them how can we get them working for our business? Let’s take an example and work from there. Let’s say we own a clothes shop (this is just for simplicity. This would, however, work for any business on the planet). Let’s say the starting figures are as follows:

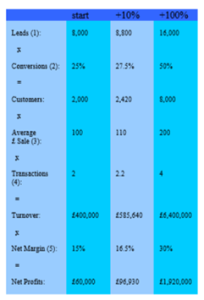

Where does the Power of Small Change Come in? Let’s try and increase each of our numbered areas by 10% and see where that leaves us:

Alright, I know the 100% increase scenario might be a little farfetched (although I actually saw it achieved once) but even the 10% scenario represents an increase in net profit (money in your pocket) of £36,930. Not bad by anyone’s standards.

That’s all well and good but my business is different!

Many business owners (normally those who can’t tell you what the above metrics are for their business) say that it would not work for their business but in reality I have never seen a business where some form of this won’t work. It is always possible. Here are a few points to remember, however:

Remember, Profit is not Cash Flow!

It is important to remember in all of this that profit is not cash flow. The majority of small business failures are actually a result of cash flow and not profit.

There are many examples of small business that sold so much so fast that they couldn’t pay their bills. Primarily because they weren’t paid quickly enough from their customers but now have to pay more bills to their suppliers to cover their newly increased sales.

To some this will sound obvious, to others it will come as a surprise. However, to me the only surprise is how many business owners actually don’t plan for their cash flow throughout the year. Often, they don’t have a basic cash flow forecast, let alone the ability to model potential changes in their businesses. For example, can you model the effect on your cash flow of?

Do you just carry out changes and assume/hope that it will be beneficial? Do you just try and increase your sales and assume/hope that this will be good for business?

Sadly, whilst increases in sales are normally good for business, surprisingly often it isn’t. It can cause a myriad of problems such as more work, increased overheads, cash flow problems, operational or production issues.

It is always better to model the changes before you carry them out to see what the impact will be on your business and, indeed, your life.

The unfortunate fact is that clichés are sometimes correct. Turnover is vanity, profit is sanity, and cash flow is reality.

Conclusion

The good news in all of this is that in order to dramatically improve the profits and cash flow in a business sometimes it only requires afew tweaks and not a major overhaul. This is normally true in many other areas of the business, such as operational efficiencies, human resource issues, financial operations and indeed in time management issues as well.

It is also easier to manage a large task such as dramatically improving a business by breaking it down into small tasks. If your business wants to start improving profits start by simply measuring where you are in each of the areas above.

Once you know where you are (and you are careful about your cash flow), we can then talk about improving each of these areas (although I have a sneaking suspicion that the act of simply measuring them will lead to improvements in your business).

"*" indicates required fields